US jobs report for April will likely point to a slower but still-strong pace of hiring

The American economy likely delivered another solid hiring gain in April, showing continuing durability in the face of the highest interest rates in two decades.

The Labor Department is expected to report Friday that employers added a healthy 233,000 jobs last month, down from a sizzling 303,000 in March but still a decidedly healthy total, according to a survey of forecasters by the data firm FactSet.

The unemployment rate is forecast to stay at 3.8%. That would make it the 27th straight month with a jobless rate below 4% — the longest such streak since the 1960s.

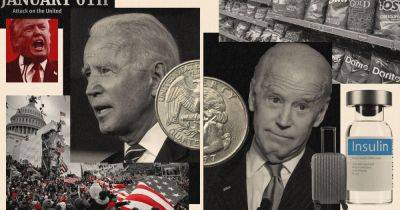

The state of the economy is weighing on voters' minds as the November presidential campaign intensifies. Despite the strength of the job market, Americans remain generally exasperated by high prices, and many of them assign blame to President Joe Biden.

Yet America's job market has repeatedly proved more robust than almost anyone had predicted. When the Federal Reserve began aggressively raising rates two years ago to fight a punishing inflation surge, most economists expected the resulting jump in borrowing costs to cause a recession and drive unemployment to painfully high levels.

The Fed raised its benchmark rate 11 times from March 2022 to July 2023, taking it to the highest level since 2001. Inflation did steadily cool as it was supposed to — from a year-over-year peak of 9.1% in June 2022 to 3.5% in March.

Yet the resilient strength of the job market and the overall economy, fueled by steady consumer spending, has kept inflation persistently above the Fed's 2% target. As a result, the Fed is delaying any consideration of interest rate cuts until it gains more confidence that inflation is steadily slowing toward its target.

So far this year, monthly job