Inflation Flat In May As Gas Prices Subside, Giving White House, Markets A Boost

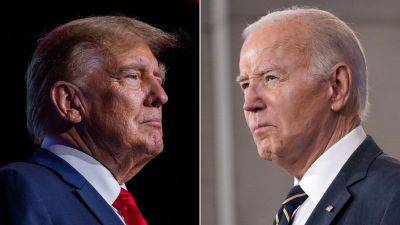

Consumer prices held steady in May, helped by a drop in what drivers paid at the gas pump, the government said Wednesday in a bit of welcome news for the White House worried about inflation’s impact on President Joe Biden’s reelection bid.

The consumer price index, the most high-profile measure of inflation, was unchanged from April to May, the Bureau of Labor Statistics said, a pause that brought the CPI’s growth over the last year down to a 3.3% rate. The flat reading in May was the best monthly showing since July 2022.

Inflation has slowed sharply from the recent peak in 2022, but high prices have meant voters still see an otherwise robust economy negatively, according to a poll by The Economist/YouGov .

However, a spokesman for the Biden campaign said the CPI report showed Biden’s economic policies were working.

“Joe Biden inherited an economy on the brink from Donald Trump and is now leading the great American comeback. Under his leadership, wages are rising, inflation is being reined in, and America’s economy is the strongest in the world,” said James Singer, a spokesperson for Biden-Harris 2024.

The report came during the second day of a two-part meeting by the Federal Reserve’s committee that sets interest rates. While the Fed is widely expected to make no moves, the report could make it easier for the central bank to justify cutting rates as early as September.

“We still need several more months of this, but the fundamentals are encouraging,” said Paul Ashworth, chief North America economist with Capital Economics in a research note to clients.

Ashworth called the idea of a September cut “still in play.”

The Fed’s preferred measure of inflation, an index of personal consumption expenditures released