Bipartisan Tax Bill Is Stuck in Senate Limbo After Broad House Approval

A bipartisan bill to expand the child tax credit and reinstate a set of business tax breaks has stalled in the Senate after winning overwhelming approval in the House, as Republicans balk at legislation they regard as too generous to low-income families.

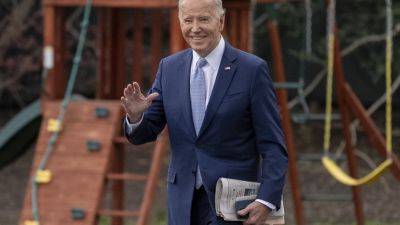

The delay of the $78 billion tax package has imperiled the measure’s chances and reflects the challenges of passing any major legislation in an election year. Enacting a new tax law would give President Biden and Democrats an achievement to campaign on, something that Republicans may prefer to avoid.

The House approved the measure in January by a vote of 357 to 72 — a major bipartisan feat in a Republican-led body that has toiled to legislate — and its backers had hoped to get it across the finish line around the start of tax-filing season at the end of that month. But with just over a month before the filing deadline, it has not moved in the Senate.

The package, which would be in effect through 2025, would expand the child tax credit and restore a set of tax breaks related to business research costs, capital expenses and interest. It would also include a boost to a tax credit encouraging the development of low-income housing, tax relief for disaster victims and tax breaks for Taiwanese workers and companies operating in the United States.

The bill would be financed by reining in the employee retention tax credit, a pandemic-era program that has become a magnet for fraud. The package was brokered by the top two congressional tax writers, Representative Jason Smith, Republican of Missouri and chairman of the Ways and Means Committee, and Senator Ron Wyden, Democrat of Oregon and chairman of the Finance Committee.